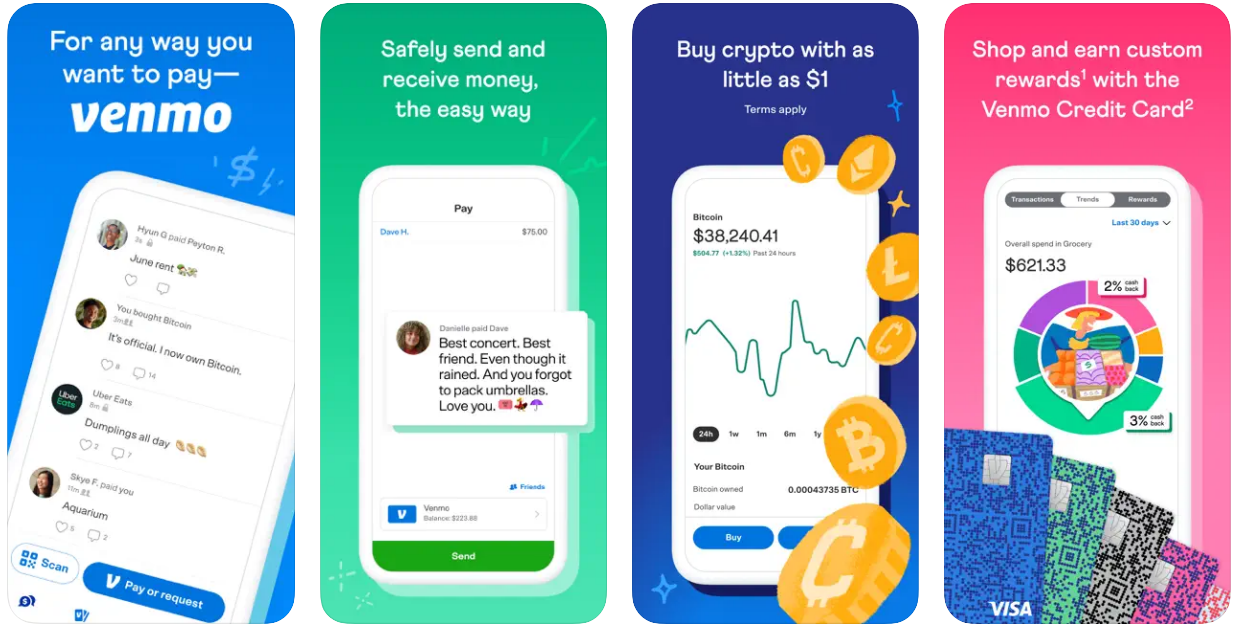

| Venmo |

Category: Finance | Rating: 4.2 |

Version: 10.12.0 | Downloads: 444.2 MB |

Updated: Feb 23, 2023 | Offered By: PayPal, Inc. |

What is Venmo?

Whether you’re looking for a simple way to split a lunch bill or to pay the rent of your roommate, Venmo can make your life easier. Venmo has more than 40 million users in the United States and is growing faster than ever.

Venmo’s easy-to-use mobile app lets you pay and request money from friends and family without any of the typical fees and hassles of other online payment services. Venmo is a safe and secure way to make money transfers, but it also has some downsides.

Venmo has a simple sign-up process. You can register using Facebook or an email address. You will also need to link a bank account and a credit card. If you link a bank account, the money transfer to Venmo will take a few days. If you link a credit card, the money will be transferred instantly.

How Does Venmo Work?

Basically, if you’ve ever wondered how does Venmo work, you’re not alone. Venmo is an online service that lets users send and receive money. In addition, it allows you to pay for services and send money to your friends.

Paying for services

Whether you are a small business owner, freelancer, or simply someone looking for a convenient way to pay for services, Venmo may be a great option for you. It offers a wide range of features, including a social component, that can help you build a business. It can also be used to reimburse employees for business expenses.

Venmo can also be used to reimburse employees for business expenditures. The company also has a pen-and-paper expense report to keep track of expenses.

Venmo offers a QR code as a touch-free payment option through business profiles. Venmo users can also link a credit card or debit card to their accounts. You can also set up a return barcode.

Sending money to friends

Using Venmo for sending money to friends is an easy way to pay for a friend’s lunch or brunch or a group event. But before you use Venmo to send money to friends, be sure to follow these tips to protect your account.

Always verify the recipient’s name and email address. You can also check their profile to see what information they have posted. If you suspect someone is trying to scam you, contact Venmo customer support to report the scam.

Venmo’s policy may offer chargeback protection for bogus transactions. If you suspect someone is trying to scam you, you may be able to cancel your request within seven days.

Sending money to a bank account

Using the Venmo mobile app to send money to a bank account can be a convenient way to get the money you need, but there are a few things to keep in mind. Before you do anything, you’ll want to check with your bank to make sure they support the service. If they don’t, you might be stuck without the money you need. You can also check your transfer’s estimated arrival date.

Venmo offers an instant transfer feature to U.S. bank accounts, but it can be a little tricky to navigate. The company says your money should arrive within one to three business days, but the actual arrival time will depend on the time of day you send the money. Sometimes, transfers take longer during holidays or weekends.

Scams involving Venmo

Using an app like Venmo is a great way to pay for purchases online. However, it is also a platform that has been used by scammers to steal money from unsuspecting users.

If you have received an unexpected payment via Venmo, you should contact the recipient to confirm whether the transaction is legitimate. This will allow you to dispute any fraudulent charges.

If you are unsure about the legitimacy of a transaction, use a long, unique passphrase. Also, double-check the email address or phone number of the sender.

If you find out that someone you know has been using your Venmo account, you should contact the company and report the issue. The company will always be willing to help.

| Venmo Free App Download |