| Dave |

Category: Finance | Rating: 4.4 |

Version: 3.15.1 | Downloads: 208.6 MB |

Updated: Feb 16, 2023 | Offered By: Dave, Inc |

Dave App Review – Is the Dave App Right For You?

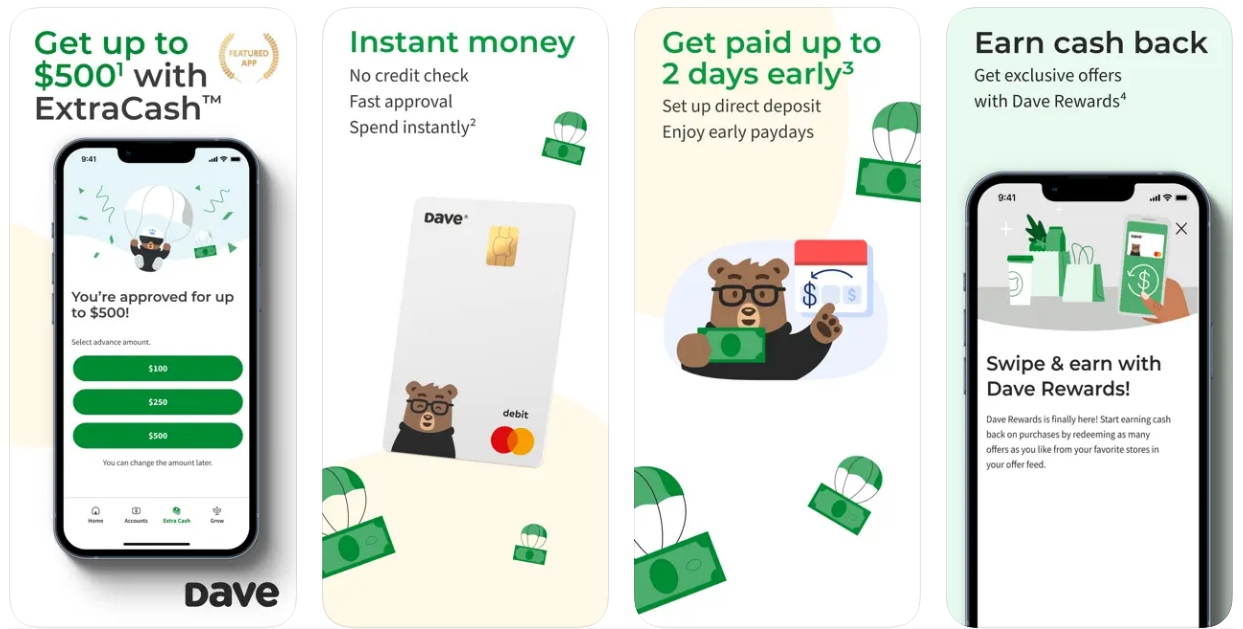

Developed in early 2017, the Dave app is a financial app that is intended to help you plan ahead and stay on top of your bills. Using the app, you can manage your monthly budget and avoid overdraft fees. It also features a cash advance feature.

The Dave app is a bit of a hybrid between an app and a service. The app is available for both Android and iOS devices. You can open an account in minutes. Upon logging in to your account, you’ll have to enter your banking credentials.

Overall, the Dave app is a surprisingly useful product that will save you money in the long run. Its free cash advance feature is a clever way to borrow money without having to pay interest. Using the app is a breeze. You can set up an account in just minutes and receive alerts when you need to.

The Dave app is a good option for people who are on a tight budget but aren’t looking for a loan. Using the app will help you avoid overdraft fees and make sure that you have enough money in your bank when you need it.

Cash advances

Apps like Dave app allow users to set up a budget and receive a cash advance. To receive a cash advance, you need to download the Dave app and link your bank account. The app will analyze your spending habits and create a budget. You will then receive an alert when your account is at risk of an overdraft.

Dave is a free financial app. However, there is a monthly membership fee. You can also pay an express fee. The express fee begins at $1.99 and tops out at $5.99 for advances of $100.

Dave is also available on Apple devices. The company has signed up 10 million members. It also offers an interest-free cash advance of up to $250.

Interest-free loan model

Dave is an app that allows users to borrow money without interest and with a low monthly fee. Dave also has a Side Hustle feature, which provides users with gig jobs. This feature is a unique selling proposition for Dave.

In addition to the Side Hustle feature, Dave also has an automatic budgeting system. This feature recommends to users how much they can spend in each category. It also warns users if they’re close to reaching their spending limit.

Automatic budgeting

Using the Dave app, you can automatically budget your expenses and find out how much money you have left to spend after paying your bills. Besides, Dave also gives you the opportunity to earn extra money by doing gigs online. You can get gig jobs through TranscribeMe, Instacart, and Airbnb.

It has partnerships with Rover, DoorDash, Instacart, and Airbnb. The app allows you to view your spending habits, link bank accounts, and receive notifications about your bills and expenses.

You can also have your paychecks directly deposited to Dave’s bank. There are no fees for a direct deposit. Moreover, you can choose an automatic payback date for your cash advances. You can also earn free credits from partnering retailers.

Side Hustle

Whether you’re looking for a side hustle to add some extra money to your budget or simply need a little breathing room, the Dave app can help. Dave is a financial app that provides a range of services, including cash advances, unbounceable checks, and income creation. It offers a friendly user experience. It also eliminates some of the inefficiencies of traditional financial services.

Dave also offers a Side Hustle feature that makes it easy to find side jobs in your area. The app works to help users find local, flexible side hustles, and it sends users reminders when a side hustle is needed to cover their bills.

| Dave Free App Download |